Executive Director Bill Feehley and Jim Arnie join us on MSATP TV for another update on the legislative changes making their way through Annapolis. Please follow us on Facebook to catch all our MSATP TV episodes live!

Jim and Bill will join us again on MSATP TV at the end of the legislative session for a review of the bills that were at first vetoed, but now have become law.

Watch on YouTube.

American Rescue Plan Act of 2021 – Don’t File Related Amended Returns Yet

The IRS urges taxpayers not to file amended returns related to the new legislative provisions or take other unnecessary steps at this time.

The IRS is reviewing implementation plans for the newly enacted American Rescue Plan Act of 2021.

Additional information will be made available as soon as possible about:

- Unemployment (IRS emphasizes not filing amended returns, until it issues additional guidance)

- New round of Economic Impact Payments

- Child Tax Credit, including advance payments

- Other tax provisions

For more information, click here.

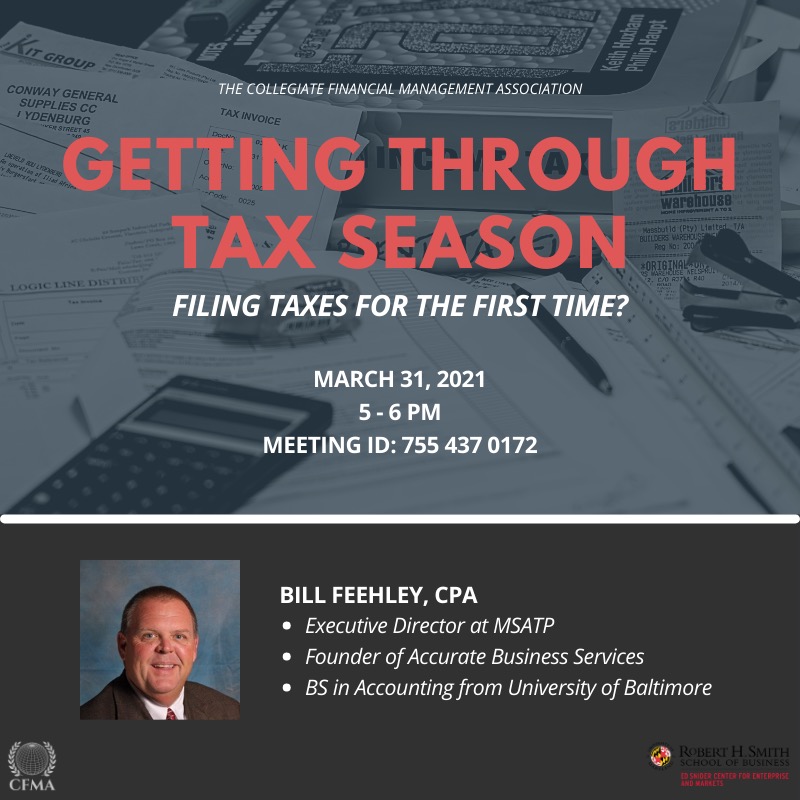

The University of Maryland Robert H. Smith School of Business is hosting an event to teach students and young professionals how to complete and file a tax return. MSATP’s Executive Director Bill Feehley will be teaching the webinar and helping you get through tax season on March 31st from 5-6pm. If you wish to register, please send webinars@msatp.org for Zoom information.

People Who Adopt May Benefit From This Special Tax Credit | IR-2021-37

The adoption process can be expensive. Fortunately, the adoption tax credit can help offset some those expenses Taxpayers who adopted or started the adoption process in 2020 should review the rules for this credit.

Here are some facts to help people understand the credit and if they can claim it when filing their taxes:

- The maximum adoption credit taxpayers can claim on their 2020 tax return is $14,300 per eligible child.

- There are income limits that could affect the amount of the credit

- Taxpayers should complete Form 8839, Qualified Adoption Expenses. They use this form to figure how much credit they can claim on their tax return.

- An eligible child must be younger than 18. If the adopted person is older, they must be physically or mentally unable to take care of themselves.

- This credit is non-refundable. This means the amount of the credit is limited to the taxpayer’s taxes due for 2020. Any credit leftover from their owed 2020 taxes can be carried forward for up to five years.

For more information, click here.

New Small Business Loans of up to $500,000 | Maryland Chamber of Commerce

The Small Business Administration announced this Wednesday that starting the week of April 6, companies harmed by the coronavirus pandemic can borrow up to $500,000 through their Economic Injury Disaster Loan program. The agency has $270 billion left to lend through the pandemic relief program and raising the cap will now allow small businesses that had previously received a loan to apply for an increase.

For more information, please click here.

Guidance on Employee Retention Credit

The IRS issued guidance for employers claiming the employee retention credit under the Coronavirus Aid, Relief, and Economic Security Act (CARES Act), as modified by the Taxpayer Certainty and Disaster Tax Relief Act of 2020 (Relief Act), for calendar quarters in 2020. This guidance applies to qualified wages paid after March 12, 2020, and before January 1, 2021 and includes clarifications and describes retroactive changes applicable to 2020, primarily relating to expanded eligibility for the credit.

The IRS plans to release additional guidance soon addressing changes for 2021.

For more information, click here.

Guidelines for the Retail Sales and Use Tax Exemption for Personal Protective Equipment

Effective March 11, 2021, Virginia House Bill 2185 and Senate Bill 1403 amend the Code of Virginia to add Va. Code § 58.1-609.14, providing a temporary exemption from the Retail Sales and Use Tax for qualifying purchases of personal protective equipment (PPE).

The exemption is only valid for qualifying purchases of PPE made on or after March 11, 2021, and prior to the expiration of the last executive order issued by Governor Northam related to the COVID-19 pandemic and the termination of the COVID-19 Emergency Temporary Standard and any permanent COVID-19 regulations adopted by the Virginia Safety and Health Codes Board. No refunds will be provided regarding purchases made prior to March 11, 2021, or after the expiration of the exemption.

For more information, click here.

Report Large Cash Transactions; E-File Encouraged

The IRS recently reminded businesses of their responsibility to file Form 8300, Report of Cash Payments Over $10,000, and encourages e-filing to help them file accurate, complete forms. A fact sheet helps businesses understand how to report large cash transactions.

For more information, click here.

What Employers Need to Know About Repayment of Deferred Payroll Taxes

The CARES Act allowed employers to defer payment of the employer’s share of Social Security tax. Employers must pay back these deferred taxes by their applicable dates.

For more information, click here.

IRS Takes Steps to Help Marijuana Businesses Stay Compliant

The Commissioner of the IRS, Small Business/Self-Employed division, Eric Hylton, gives candid insights on a variety of cannabis industry issues from the federal perspective at an informational webinar; hosted by the Payments Banking and Compliance Conference. One of those issues being that states are already legalizing marijuana regardless of federal policy, creating complications that need to be addressed.

For more information, click here.

Important Reminder Regarding ERC and PPP | Payroll Services LLC

Quarter 2 ERC:

As we enter the second quarter, if you qualified for the ERC based on revenue decline only, you will need to be sure you still qualify. You may qualify using Q1 2021 to Q1 2019, or if at the end of Q2, use Q2 2021 to Q2 2019.

Be sure to be on the look out for “re-opening” changes that may alter your “partial suspension” qualifications. We do our best to stay up to date on the surrounding states, however each County may do things different. If you have questions about your particular situation please reach out to us to discuss.

The ERC balances “reset” on April 1st. All qualified wages up to $10,000 will be eligible for a 70% refundable credit.

If you now qualify due to revenue decline please reach out to us so we can help you!

Reminder:

Many customers are now beginning to apply and or receive PPP funds. Please be sure to let us know immediately when you receive PPP funds. We will need to know the amount and the date you received funds.

Covered Period:

It is important that all customers use the 24 week Covered Period for both the 2020 PPP and 2021 PPP. If you are choosing to use another Covered Period, you must let us know immediately, otherwise we will use the 24 week period in our calculations.

IRS, Treasury Disburse Another 37 Million Economic Impact Payments from The American Rescue Plan | IR-2021-63

Today, the Internal Revenue Service, the U.S. Department of the Treasury and the Bureau of the Fiscal Service announced they are disbursing approximately 37 million payments in the second batch of Economic Impact Payments from the American Rescue Plan. This brings the total disbursed payments from the American Rescue Plan to approximately 127 million payments worth approximately $325 billion.

As announced on March 12, Economic Impact Payments will continue to roll out in batches to millions of Americans in the coming weeks.

For more information please click here.

Revenue Procedure 2021-19 and 2021-17 | RP-2021-19 & RP-2021-17

Revenue Procedure 2021-17 provides issuers of qualified mortgage bonds, as defined in § 143(a) of the Internal Revenue Code (Code), and issuers of mortgage credit certificates, as defined in § 25(c), with (1) the nationwide average purchase price for residences located in the United States, and (2) average area purchase price safe harbors for residences located in statistical areas in each state, the District of Columbia, Puerto Rico, the Northern Mariana Islands, American Samoa, the Virgin Islands, and Guam.

Revenue Procedure 2021-19 provides guidance with respect to the United States and area median gross income figures for use by issuers of qualified mortgage bonds under § 143(a) of the Internal Revenue Code and issuers of mortgage credit certificates under § 25(c) (collectively, “issuers”) in computing the income requirements under § 143(f). This revenue procedure provides that issuers must use either (1) the income figures the Department of Housing and Urban Development (“HUD”) released most recently or (2) the income figures HUD released immediately prior to the income figures HUD released most recently, determined as of the date a mortgage loan or mortgage credit certificate is committed to a mortgagor. This revenue procedure also provides a 90-day transition period, following the release of the HUD income figures in a current calendar year, for issuers to use the income figures HUD released during the second calendar year prior to the current calendar year. The Department of the Treasury and the IRS have decided to publish this revenue procedure as permanent guidance consistent with comments received and to cease publishing annual revenue procedures providing income figures for purposes of computing the income requirements of § 143(f).