On Friday evening, the Maryland Society of Accounting & Tax Professionals (MSATP) hosted its 2025 Annual Banquet at Ruth’s Chris Steakhouse in Pikesville, MD. The evening was filled with warmth, reflection, and a strong sense of community as members came together to celebrate another impactful year of leadership, service, and professional excellence.

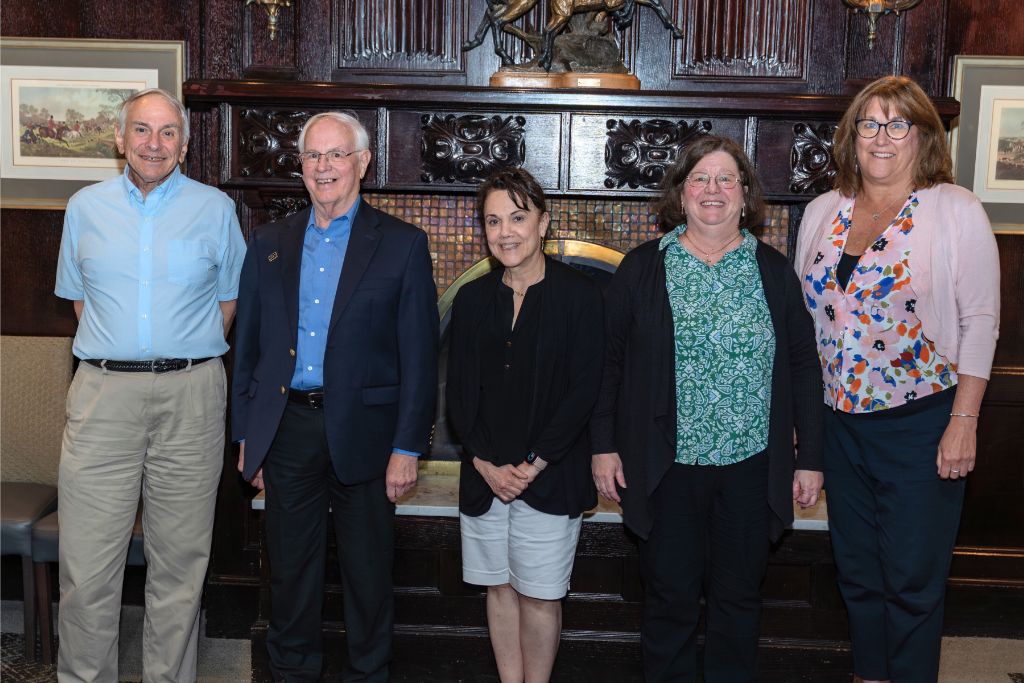

Welcoming the 2025–2026 Board of Directors

The heart of the evening was the induction of MSATP’s 2025–2026 Board of Directors and Officers. With an inspiring commitment to service and advocacy, these individuals will guide our Society into the future with purpose and integrity.

Officers:

-

President: Ann Elliott, EA

-

1st Vice President: Hannah Coyle, EA

-

2nd Vice President: Christopher Williams

-

Treasurer: Michael McIlhargey, CPA

-

Secretary: Matthew Eddleman, EA

Elected Delegates:

Standing Board Members:

-

Immediate Past President: Donya Oneto, CPA

-

Board of Trustees Delegate: Bob Medbery, CPA

-

Executive Director: Giavante’ Hawkins

Together, this dynamic group represents a diverse cross-section of Maryland’s accounting and tax professionals and will continue to advance MSATP’s mission of advocacy, education, and community.

Honoring Excellence with Special Awards

The banquet also served as an opportunity to recognize outstanding contributions to the Society and the profession. These awards reflect the values that define MSATP: integrity, leadership, mentorship, and community support.

Leadership Institute Recognition:

Participants Kyarah Mair and Shakeara Lynch completed the inaugural MSATP Accounting Leadership Institute. Shakeara Lynch received the Capstone Award and a $300 scholarship in honor of MSATP Past President Phyllis Burlage.

President’s Award:

Presented posthumously to Christine Giovetti, a past president and beloved member whose legacy of service and advocacy continues to inspire.

Sidney Weinberg Award:

Awarded to Hannah Coyle, EA for her emerging leadership and impact on the Society.

Life Membership Award:

Presented to Barbara Smith, CPA for her long-standing service and mentorship.

Board of Directors Service Awards:

-

Barbara Smith, CPA

-

Ellen Silverstein, CPA

-

Sean Coggins, CPA

Golden Quill Award:

Awarded to Jonathan Rivlin for his exceptional written contributions to the profession.

Outstanding Young Professional Award:

Presented to Keila Hill-Trawick for her thought leadership, advocacy for small firm owners, and national recognition as one of the top voices in the profession.

Ted Schultz Award for Volunteerism:

Awarded to Andrea Foster for her active service and leadership in the Society’s upcoming strategic planning efforts.

Special Recognition Award:

Given to Bob Medbery, CPA for his compassionate support of the Giovetti family through the Assistance Committee.

Performance Awards:

-

Krista Sermon, Maryland Comptroller’s Office

-

Veronica Tubman, IRS (Retired)

Both honorees were recognized for their continued support and collaboration with MSATP and the accounting community.

Past President’s Award:

Presented to Donya Oneto, CPA, the longest-serving acting president in MSATP history, for her unwavering leadership during a challenging transitional period.

Board of Trustee Award:

MSATP’s highest honor was awarded to Bob Medbery, CPA for his exceptional leadership, integrity, and service to our members through the Assistance Committee.

A Night to Remember

The banquet concluded with a heartfelt acknowledgment of the Board of Trustees—all past presidents—who stood to welcome the newly inducted board members. As always, the event reminded us that MSATP is more than an association—it’s a thriving, inclusive community built on the values of service, collaboration, and growth.

To all our members, award recipients, and guests—thank you for making this evening one to remember. We look forward to continuing this journey with you in the year ahead.

Together, We Thrive.