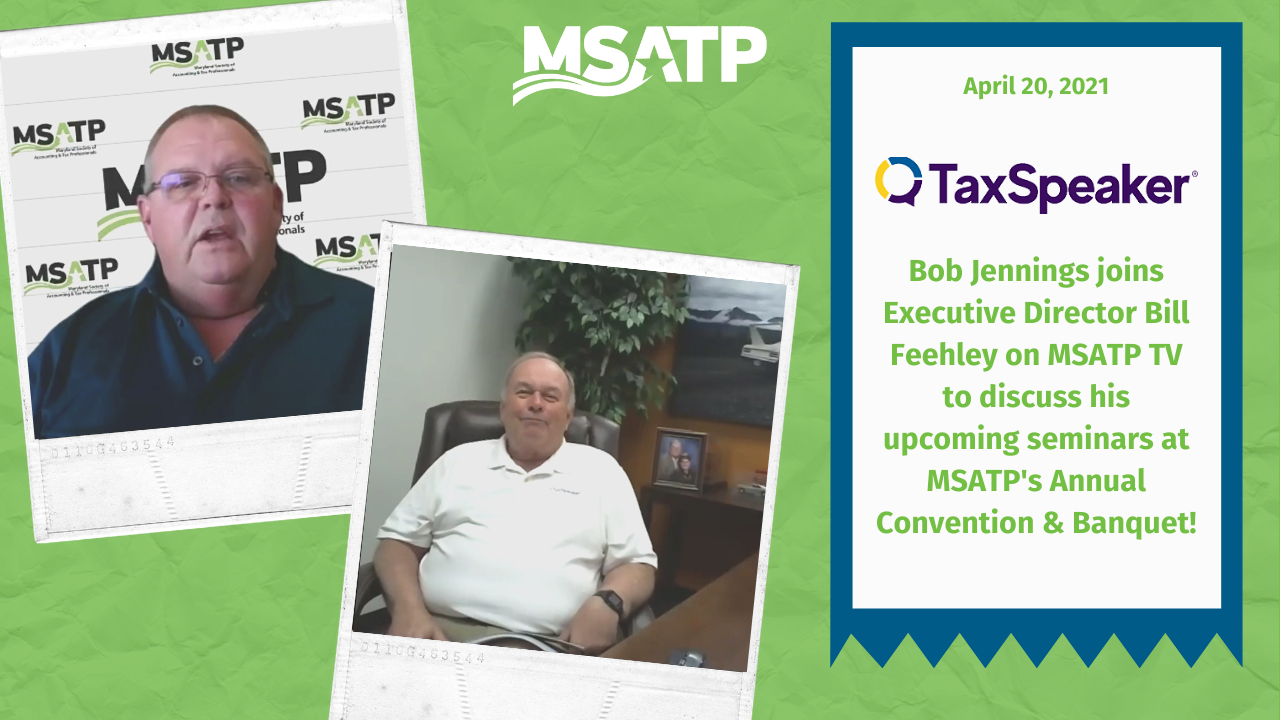

On this week’s episode of MSATP TV, Bob Jennings joins Executive Director Bill Feehley to tell us about his classes TaxSpeaker Security and Preparations, Compilations and Reviews. He will be presenting both of these classes at the MSATP Annual Convention & Banquet in Ocean City, MD on June 2-3, 2021.

Watch on YouTube.

Coming Up: On Thursday, April 29th at 10 a.m., Jim Arnie will join Bill Feehley on MSATP TV to give us a wrap up on the legislative session in Annapolis. Tune in on Facebook for one last up date on the 2021 legislative session.

American Rescue Plan Tax Credits Available to Small Employers to Provide Paid Leave to Employees Receiving COVID-19 Vaccines; New Fact Sheet Outlines Details | IR-2021-90

The Internal Revenue Service and the Treasury Department announced today further details of tax credits available under the American Rescue Plan to help small businesses, including providing paid leave for employees receiving COVID-19 vaccinations.

The additional details, provided in a fact sheet released today, spell out some basic facts about the employers eligible for the tax credits. It also provides information on how these employers may claim the credit for leave paid to employees related to COVID-19 vaccinations

Eligible employers, such as businesses and tax-exempt organizations with fewer than 500 employees and certain governmental employers, can receive a tax credit for providing paid time off for each employee receiving the vaccine and for any time needed to recover from the vaccine. For example, if an eligible employer offers employees a paid day off in order to get vaccinated, the employer can receive a tax credit equal to the wages paid to employees for that day (up to certain limits).

For more information, click here.

Second Round of Economic Impact Payments | 2021-04

The Coronavirus Response and Relief Supplemental Appropriations Act Second Round Economic Impact Payment data are now available on SOI’s Tax Stats Web page. The Coronavirus Response and Relief Supplemental Appropriations Act, enacted in December 2020, created a second round of advance cash payments to individuals. These tabulations provide data on the second round of Economic Impact Payments by adjusted gross income, State, and marital status. Data on the third round of Economic Impact Payments from the American Rescue Plan Act of 2021 will be available at a later date.

For more information, click here.

Taxpayer Should File Their Tax Return on Time Even if They Can’t Pay Their Tax Bill in Full | Tax Tip 2021-53

Taxpayers should file their tax return by the deadline even if they cannot pay the full amount due.

If an individual taxpayer owes taxes, but can’t pay in full by the May 17, 2021 deadline, they should:

File their tax return or request an extension of time to file by the May 17 deadline.

- People who owe tax and do not file their return on time or request an extension may face a failure-to-file penalty for not filing on time.

- Taxpayers should remember that an extension of time to file is not an extension of time to pay. An extension gives taxpayers until October 15, 2021 to file their 2019 tax return, but taxes owed are still due May 17, 2021.

For more information, click here.

Digital Advertising Gross Revenues Tax and Tobacco Tax Alterations and Implementaion | SB 787

Due to the broad interpretation of what “digital goods” were subject to a new sales tax in HB932 of 2020, the MDCC formed a working group of tax experts to develop a set of recommended amendments providing clarity in the law. After much work, amendments on two major issues were agreed upon and included in SB 787, which passed Monday night and awaiting review from the Governor.

The amendments do two things:

- Clarify that a taxable “digital product” does not include educational instruction or seminars conducted by educational institutions or professional organizations and business associations.

- Clarify that certain types of computer software and related services are not taxable, where the purchase involves software that is unusable until it is configured or modified as necessary to perform the required functions and for the software to operate as intended. This is often referred to as “enterprise software” used by businesses.

For more information, click here.