By Bob Jennings, CPA, EA, CFP® of TaxSpeaker

Many employees incur job related expenses such as mileage, travel, entertainment, dues, licenses, supplies, office equipment, etc. An employee whose employer requires the employee to provide for and pay for such expenses essentially makes the employee pay income and social security tax on the expenses.

Because employee miscellaneous itemized deductions are no longer deductible on a Federal return under the 2017 Tax Cuts and Jobs Act, these are the worst expenses an employee can incur, and the employee must push strongly for an accountable expense plan (or direct employer payment) of these expenses.

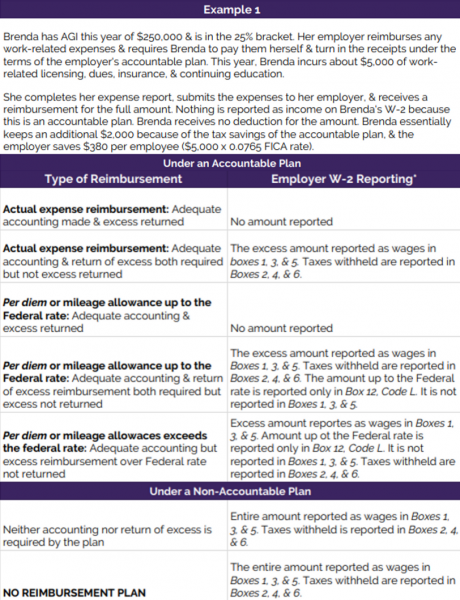

Many employers do not recognize the cost to the employee and also do not recognize the savings they could obtain by establishing an accountable expense plan. Accountable plans should be used by most employers for reimbursing auto expenses, travel, licenses, dues, and meals & entertainment. An accountable plan is an allowance or reimbursement policy (not necessarily a written plan) under which amounts are nontaxable to the recipient if the following requirements are met:

- There must be a business connection to the expenditure.

- There must be adequate accounting by the recipient within a reasonable period of time. (Usually 60 days) (advances must be made no more than 30 days before the expense)

- Excess reimbursements or advances must be returned within a reasonable period of time. (120 days) IRC §62(c); Reg. §1.62-2.

Without an accountable plan in place all employee expenses fall under the miscellaneous expense non-deductible rule, and any cash payments by the employer to the employee are taxed as wage income. With an accountable plan, any amounts reimbursed to the employee are not reportable to the employee nor deductible by the employee. The TaxSpeaker USB Drive includes an example accountable plan.